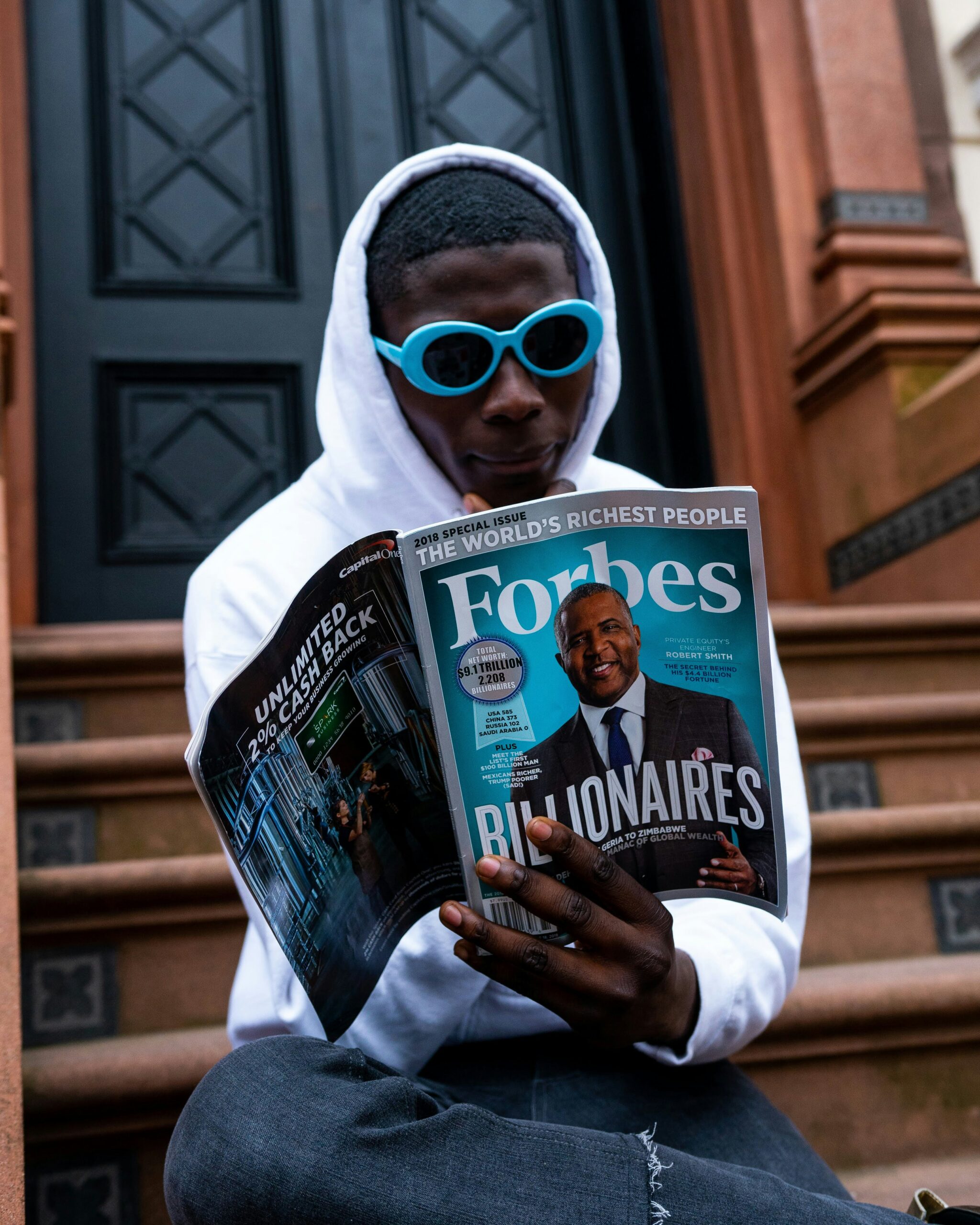

Photo by Stephanie McCabe on Unsplash

In adding to my list of topics to write about, many included reference to the concept of FIRE, so I figured I should dedicate an article that goes into explaining what it is.

FIRE stands for “Financial Independence, Retire Early.” It’s the idea of building enough wealth to no longer be dependent on a job and ditch waiting to retire at the so-called “traditional” age of sixty-five. Like Outback Steakhouse, FIRE embraces a, “no rules, just right” mindset.

When it comes to the accumulation of funds and “Financial Independence,” spending less while saving and investing more is the overarching theme. The rate at which you do this is dependent on your FIRE number (i.e. the amount of money which you can comfortably live off of sans job) and how quickly you wish to reach it. There are formulas and suggestions for how to establish your FIRE number, but bottom line is that it’s dependent on your own expenses and living preferences.

The level of frugality used to achieve FIRE is different for everyone as well. One person might forgo owning a new car while another person might move to an entirely new city because it has a low cost of living. The goal is to make conscious decisions about where your money goes and what it’s working toward.

As for the “Retire Early” aspect of FIRE, it does encompass leaving your employer, but it does not demand that you never have a source of income upon achieving your FIRE number. “Retire Early” represents the larger picture of having the power to decide what you do with your time every day and having the choice to no longer work. There are some practitioners of FIRE who say they are only or more focused on the “FI” than the “RE,” because they don’t want to stop working altogether, plan to have a part-time job, and so on, but I’d argue that this distinction is unnecessary.

Retirement is not something that is guaranteed to everyone. 49% of adults ages 55 to 66 had no personal retirement savings in 2017, according to the U.S. Census Bureau’s Survey of Income and Program Participation (SIPP). (This and other interesting in depth retirement statistics are covered in the Census article by Brittany King and can be read here).

Having the freedom to say paid work is optional rather than essential is an enormous privilege, especially in a country where basic necessities such as education, healthcare, housing, and elder care are not guaranteed (looking at you United States).

FIRE breaks away from the work-centric culture and motto of “love what you do” and expands it into the more personalized and fulfilling objective of “love how you live.”