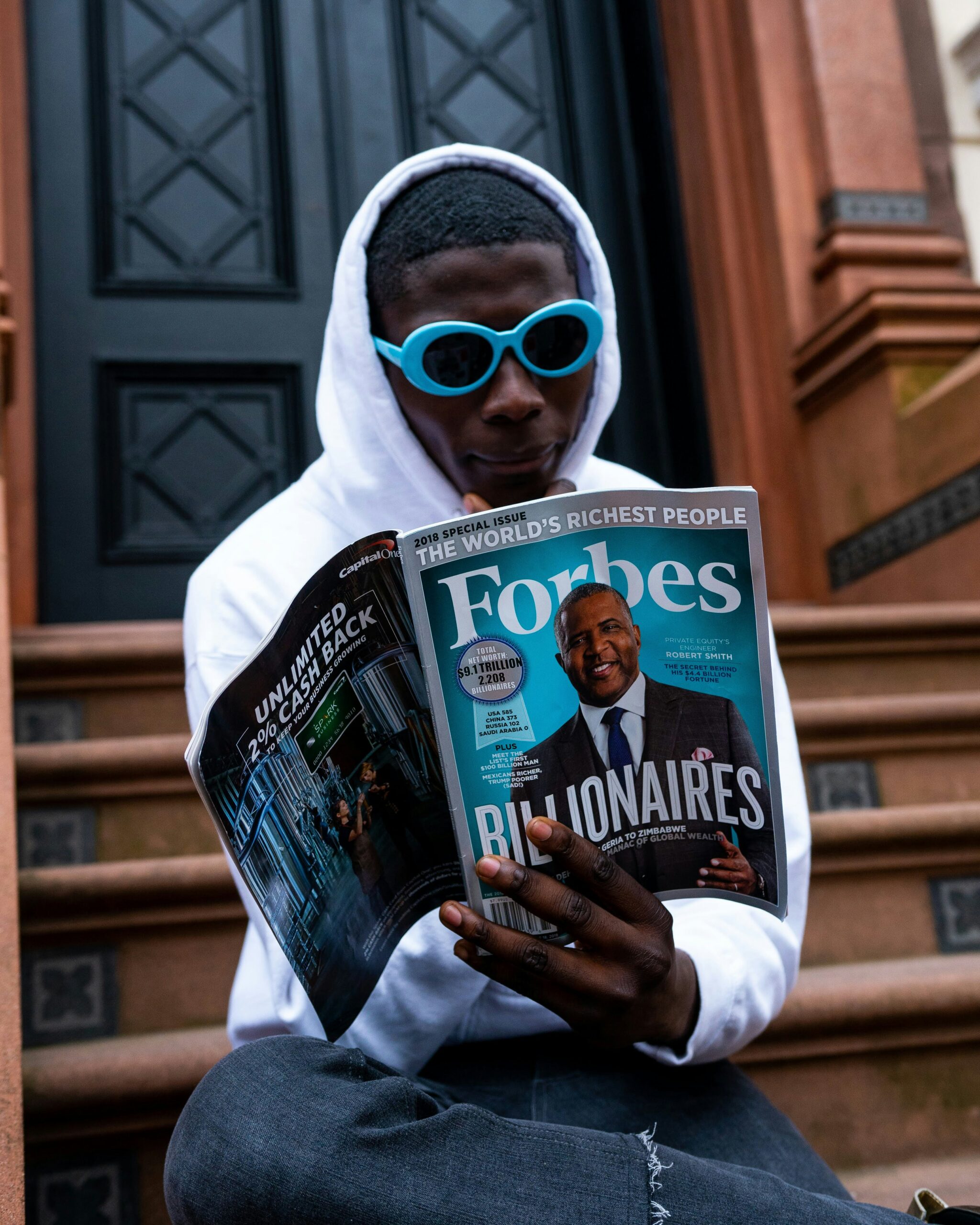

Photo by Vardan Papikyan on Unsplash

For any articles about credit cards, I feel that I need the disclaimer/reminder that credit cards are not your friend, they are your frenemy. In order to make as much money off of you as possible, credit cards buddy up with you to encourage you to use them irresponsibly, overspend, and not pay them off on time or in full. Do not do this. Swipe mindfully, with caution, and pay them off to ensure credit cards work in your favor rather than lead to your financial demise.

Now, on to the credit cards that can provide you as much cash back on your purchases as possible. Personally, I prefer credit cards that reward in cash rather than points or miles. Cash back holds your rewards to a firm standard of a specific percentage back on each purchase made. They are an indisputable tangible amount of money.

If your rewards are in points or miles, they are subject to an exchange rate determined by the credit card company and can only be utilized through the credit card company… That setup is not going to work in your favor.

I’ve heard numerous stories of flights booked or tickets bought using points/miles that were then impossible to change and simply led to the rewards being lost forever rather than refunded because they were not money, but “points.”

In the spirit and goal of adding money to your wallet, below are five credit cards that can help you to get at least 3% back on purchases made using them. None of them have annual fees (and in general, credit cards that do have annual fees aren’t worth it — most of the perks those cards offer can be found through other credit cards without an annual fee).

Citi Custom Cash Card

The Citi Custom Cash Card allows you to earn 5% cash back on up to $500 of purchases in your highest eligible spend category each billing cycle (i.e. about every 30 days). The spend categories are restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs and live entertainment. Because the card only offers 5% back on up to $500 of purchases that are in your highest eligible spend category and provides 1% back on all purchases outside of that, this card is best utilized solely for purchases in your preferred spend category. For example, if you spent a total of $400 at “restaurants” one month and used this card for those purchases, you’d get $20 back. The card currently has an opening bonus of $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening.

Capital One SavorOne Cash Rewards Card

The Capital One SavorOne Cash Rewards Card gives you 3% cash back on dining, entertainment, specific streaming services and at grocery stores. It offers 1% cash back on all other purchases, so stick to the same rule of using this card for purchases that fall under their 3% category for the most cash back. If you are interested in this card, you can use my referral link here and there’s an opening bonus of $200 if you spend $500 on purchases within the first 3 months from account opening.

U.S. Bank Cash+ Visa Signature Card

The U.S. Bank Cash+ Visa Signature Card provides 5% cash back on two “Cash+” categories of your choice (the full list is here), 2% cash back on their “everyday” categories (grocery stores, gas stations, and restaurants), and 1% cash back on everything else. This card is a good way to earn 5% back on monthly bills such as utilities and your cell phone provider. It also currently has an opening bonus of $200 if you spend $1,000 on eligible purchases within the first 120 days of opening the account.

Chase Freedom Flex Credit Card

The Chase Freedom Flex Credit Card offers 5% cash back on their “quarterly bonus categories.” This year, the bonus categories each quarter were grocery stores and eBay (January through March), Amazon.com and select streaming services (April through June), gas stations, rental cars, movie theaters, and select live entertainment (July through September), and are Walmart and purchases made using PayPal from October through December. A con of this card (in addition to not being able to choose what you get 5% cash back on each quarter) is that the enrollment in those 5% categories is not automatic. You have to “activate” it each quarter by logging into your card’s account. If you don’t, you’ll only get 1% back on those purchases. If interested in this card, it does currently offer a good opening bonus. You get $200 after you spend $500 on purchases in the first 3 months from account opening, plus you earn 5% cash back on grocery store purchases (excluding Target and Walmart) for one year.

Kroger Rewards World Elite Mastercard

Put simply, the Kroger Rewards World Elite Mastercard is not great, however, it does make it easy to get 5% cash back on any purchases made with a mobile wallet. These purchases are capped at a total of $3,000 per calendar year, so if you find yourself often using a mobile wallet for your purchases, this is the card for you. Ironically, the card only gives 2% cash back on purchases from their own grocery stores and requires a minimum of $10 in rewards in order to cash them out (like I said the card isn’t great), but I’m listing it here because it guarantees 5% cash back anywhere that accepts payment with a mobile wallet. You’re not limited to a specific category or type of business like with other cards. Note that if you are interested in this credit card and shop at Kroger grocery stores, keep a lookout on your Kroger receipts for an opening bonus offer of a $100 statement credit after you spend $500 in the first 90 days of receiving your card.

For an added boost of cash back from credit cards, sign into your credit card accounts and see if they offer “merchant rewards” or additional cash back offers at specific retailers that you can add to your card.

Remember, credit cards do not want what’s best for you, but when used wisely, they can give you cash back/make the things you buy with them a little bit cheaper.