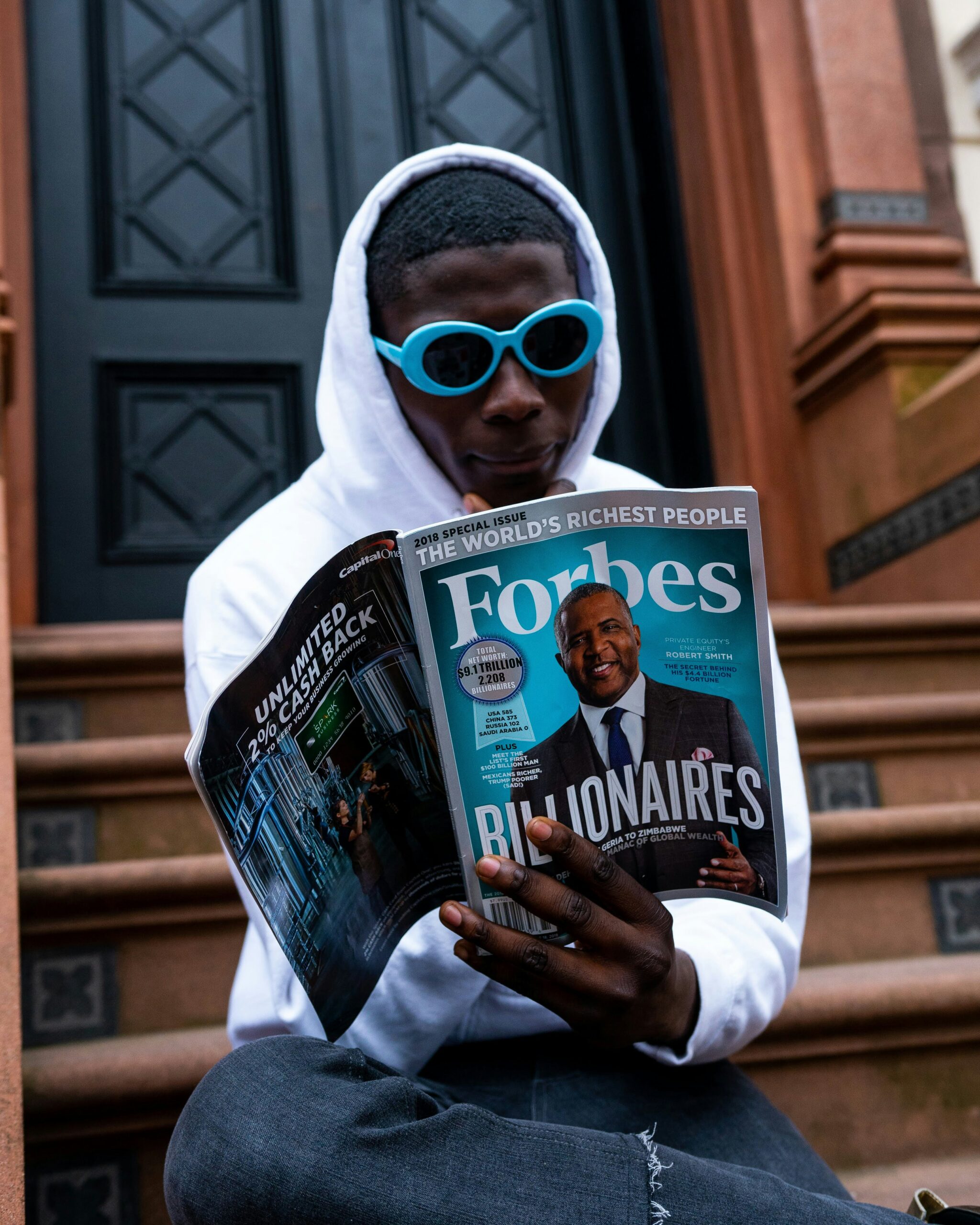

Photo by Lidya Nada on Unsplash

The year was 2019. I had a three-week international trip (hell yeah) in the works and determined that I should also have a credit card in my wallet for the occasion.

With this, I settled on a promising travel-focused card which shall remain unnamed — no foreign transaction fees, an opening bonus that I would achieve through my trip costs, TSA PreCheck, an annual fee waived for the first year, plus I could earn two miles per dollar on every purchase — this was the one for me.

Cut to 2022. I was paying an annual fee of $95 (totaling $285 at this point) for a credit card I barely used and was no longer benefitting me. I might’ve come to the conclusion later than was ideal, but it was time to say goodbye to this card.

As I set a date to call customer service and cancel the credit card, I buckled in for the inevitably bumpy ride of a plummeting credit score. The card was one of my most aged accounts, so I didn’t have high hopes.

The more I researched what my credit score was comprised of, however, I realized it was possible to ensure that the impact of closing a credit card was more like a speck of dust rather than a devastating torpedo.

FICO credit scores are made up of five pieces: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). You can read more about it on the FICO site here.

After closing my credit card, my credit score went down only one point. If you’re looking to rid yourself of a credit card that’s only causing harm, you can do so and defend your credit score by following these three protective measures:

Decrease your usage of ALL credit cards

The general rule for your credit utilization (aka the “amounts owed” portion of your credit score) to have a positive effect is to use 30% or less (ideally 10% or less for best results) of the credit limits on your open credit cards and lines of credit.

The card I wanted to cancel had a credit limit of $7,000. Closing it would decrease my total available credit by that amount, so I needed to make sure that doing so wouldn’t also cause my credit utilization amount to skyrocket. For example, even I had no balance ($0) on a card I wanted to cancel but had a $2,000 balance and $1,500 balance on my two other hypothetical forms of credit (credit cards with $5,000 limits), canceling the card with no balance would raise my credit utilization from 20.5% ($3,500/$17,000) to 35% ($3,500/$10,000).

By keeping the balance of ALL my credit cards low, rather than only the one I wished to cancel, my credit utilization percentage was able to remain low and almost unchanged after canceling the card. Additionally, any payments I made on the balance of my cards to keep my credit utilization low helped boost the “payment history” category (i.e making timely payments) of my credit score (for clarity, prior to officially canceling the card, its balance was paid off altogether — make sure you do this so you’re not stuck making payments, accruing interest, adding debt to your record, or having to think about the card afterward; some issuers also require the credit card to be paid off in order to close it).

If you’re looking to cancel a card, calculate what doing so will make your credit utilization ratio by using the formula [(total of credit card balances) + (total of other revolving lines of credit balance)]/(total credit limit for cards and other revolving lines of credit).

Evaluate the age of your credit accounts

The “length of credit history” is based on the average age of all of your open accounts (i.e. the ages of all your open accounts divided by the number of them). Zero to four years of credit history is considered not great, five to six is okay, seven to eight is good, and anything over nine is the pinnacle of existence.

For me, the age of my credit history was closer to a newborn than a pre-teen. With this, however, it meant that closing my credit card would not change anything in regard to my “length of credit history.” Even though the credit card had been open for over three years and was my second oldest open credit account, the overall age of my credit accounts was under four years whether or not it stayed open. I also kept the card open as long as possible (i.e. one month before the next annual fee would be due) in order for my other credit accounts and score to accumulate more time and responsible usage history.

If you would like to close a credit card and find that doing so might hurt your “length of credit history,” see if there is a way to avoid doing so or lessen the blow (such as delaying the closure). Also remember that as long as the card does not charge you a fee to remain open or have consequences for not using it, the healthiest course of action for your credit is to tuck the card away and never use it.

Know all of your options

When you want to cancel a credit card, the likelihood that it’s with an issuer that offers more than one type of credit card is high. Because of this, it’s good to check with their customer service about all of your available alternatives to canceling that will not affect your credit score.

First off, ask if they will waive the upcoming fee or adjust whatever elements of the card you take issue with (the worst they’ll say is “no”). Another option is inquiring if it is possible to change your current card to another one of their credit cards that does appeal to you (and has the features you’re looking for). If the issuer allows this, you should retain your current card’s history on your credit report and prevent a change in your credit score (double-check with them for certainty).

If you already have multiple credit cards with the issuer of the card you wish to cancel, you can also see if you’re able to close the desired card, but transfer its credit limit to your other existing card when doing so. This way your total credit limit will remain the same.

Additionally, you can request higher credit limits for your existing credit cards in general. There should be no effect on your credit score if any of the issuers deny the request (though of course make sure of this with each specific provider to be safe) and increases your total credit limit, so there is less of a decline to it when you close your card.

When it came to canceling my own card, I was told by the issuer that none of the above options could be done, (womp womp), and I did not increase any of the limits of my existing cards from other issuers because I had calculated that my credit utilization was already low enough without doing so. Even with this, I still encourage you to discover, understand, and consider all of your choices in getting rid of a credit card so you can do what is best for you.

In the words of the classic public service announcements, “the more you know” is true. By expanding your knowledge about how credit and lending work, the more freedom you have in dealing with them.